Explaining CCRC Contract Types: A Guide to Get You Started

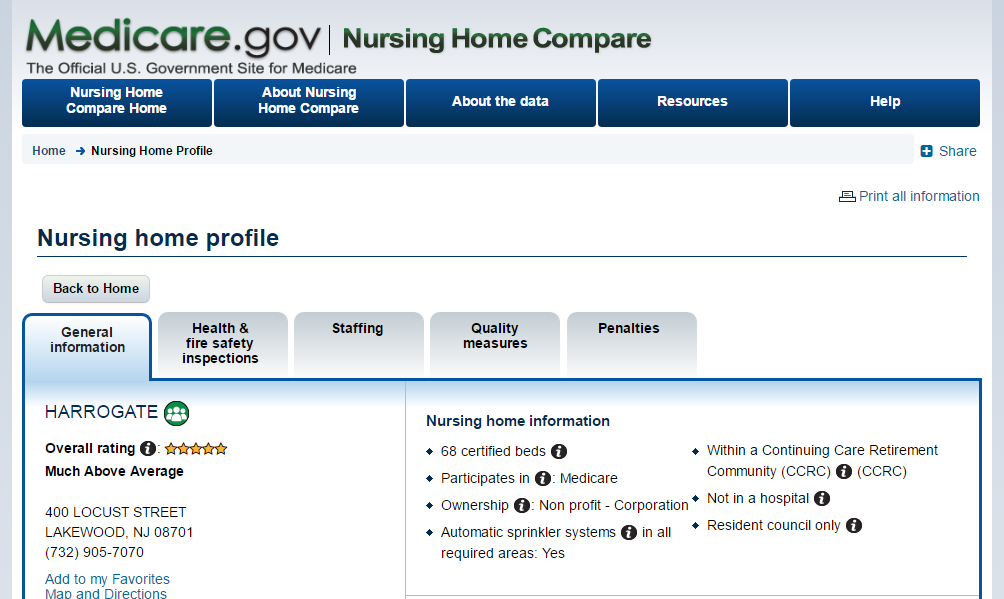

A Continuing Care Retirement Community, or CCRC, is the exact same thing as a Life Plan Community. (Harrogate uses the term Life Plan Community.) But not all CCRCs (or Life Plan Communities) are created equal. Confused? Here’s a guide with detailed information to help you keep it all straight.

Throughout this article, you’ll see the more commonly recognized term, CCRC, when referring to communities. And to help you make sense of all the CCRC options available to you, here’s some of what we’ll cover: CCRC contract types, specifically what a CCRC Life Care contract is, and the fee structure of a CCRC. We’ll also discuss one of the benefits of choosing a CCRC — the entrance fee tax deduction.

CCRC CONTRACT TYPES.

There are several types of CCRCs and CCRC contract types out there – let’s break it down.

Type A, also referred to as Life Care:

At a Life Care community, you pay a one-time fee before you move in, which can offer refundability to you or your estate. After you move in, you also pay a monthly service fee, which we’ll explain a bit later. Type A contracts often ensure a few things: No matter what level of living you choose when you move to the community, you’ll usually have a home providing you unlimited priority access to all levels of care the community offers at predictable rates, for life. And generally, you’ll pay less for any care you need than you would on the open market. If you or your spouse need different levels of care, you’ll often pay just one monthly fee plus a nominal increase in the fee for your spouse.

Type B, often called a modified Life Care:

These communities include housing and services and amenities. Just like at a Type A community, you’ll pay a one-time entrance fee and your monthly service fee. However, the care structure is vastly different.

As part of your entrance fee, you may receive care in one of two ways:

A limited number of free days of health care, with additional days billed at per diem market rates, or an ongoing, minimally discounted rate. However, if you and your spouse need different levels of care, you may end up paying two monthly service fees to cover those two different care levels.

Type C, also known as fee-for-service:

Housing and services are provided, and the entrance fee and monthly service fee tend to be lower than with the other two contract types. You may have access to care, but it will be charged at full market rates, which are typically significantly higher than a Type A or B contract. Also, if you live in independent living but need care on a short-term basis, you will be required to pay your monthly service fee for your independent living residence plus the costs of housing and the health care your spouse receives.

Rental:

Not all CCRCs require an entrance fee — rental communities operate more like a leasing agent, charging you rent by the month. Some rental communities may have year-long leases; others are literally month-to-month obligations. People who choose rentals may prefer both the flexibility and the fact their money isn’t tied up in an entrance fee. However, because they only collect one fee, fewer dollars are spent on services and more are spent on debt services and emergency capital improvements. The monthly service fee could also increase more quickly to produce additional revenue. And many rental contracts don’t provide you with priority access to health care services — so any available space on the health care side of the community can be given to someone outside the community, instead of to you when you need it most. And you’ll pay full market rates for that care just like a fee-for-service community. A rental community can be a CCRC or a stand-alone community with a single offering.

WHAT ARE ENTRANCE FEES?

An entrance fee is a one-time, upfront fee you pay to move into the independent living part of a senior living community. The amount of the entrance fee varies, depending on the size of the residence you choose, whether it will be just you or you and another person living in that residence, and the contract option you select. At a CCRC community requiring an entrance fee, you can expect multiple contract options offering varying levels of refundability to you or your estate. For example, at Harrogate, there are several contract options to select from that will guarantee you a refund.

Life Care entrance fee tax deduction:

The IRS recognizes that a Life Care contract is one where you’re prepaying medical expenses, meaning a good portion of your monthly fees are tax-deductible. And that’s true whether you receive health care services or not. Generally, regardless of which type of contract you choose, deductions are available. Because tax deductions change frequently, it’s best to talk with your tax professional for all the details.

WHAT ARE MONTHLY SERVICE FEES?

Monthly service fees are just what the name suggests: a fee you pay every month that covers the services and amenities package associated with living at the community. The amount you pay depends on the size of your residence, how many people live there, and the range of services and amenities available to you in your level of living: independent living, assisted living, memory care or skilled nursing.

Interestingly, according to this recent article from TheStreet.com, housing, not health care, was the number one expenditure for retirees over 65. Housing costs include mortgage (if you have one), property taxes, insurance, utility bills, maintenance and homeowner’s association fees – but at a senior living community, these are the types of expenses your monthly service fee pays for, along with so much more.

That “so much more” includes services such as:

- All maintenance, both inside and outside your home

- Regular housekeeping, which often includes flat linen service (at Harrogate, we provide this service weekly)

- Utilities – usually all except for internet and telephone

- Scheduled transportation to events, shopping, medical appointments

- On-site 24/7 security

- Emergency response system

As well as amenities, including:

- A dining plan with a variety of dining choices and chef-prepared meals

- Access to the community’s fitness offerings (Harrogate, for instance, has an indoor heated pool and fitness center with full-time instructor)

- Use of all common spaces (at Harrogate, those include an auditorium with regularly scheduled performances, bocce ball courts, outdoor gazebos, walking trails, card rooms, woodworking shop, garden and dog park).

- A full monthly calendar of outings, activities, events, etc.

The list of services and amenities goes on, but you only pay one bill each month.

HOW DOES THE ENTRANCE FEE REFUNDABILITY WORK?

At a CCRC, you don’t actually own your residence; however, most CCRC agreements stipulate that refunds will not be paid until your residence is “resold and reoccupied.” As with any big financial decision, read the contract thoroughly, and ask lots of questions to understand exactly what you’ll be getting back, and when.

COMMONLY ASKED QUESTIONS

Kevin Fletcher has answered countless questions during his tenure as Harrogate’s director of sales and marketing. Here are a few he hears most often, along with his answers:

Q: As a prospective resident, what should I look for when I visit a CCRC?

A: Look beyond what independent living offers you, and request a tour of the CCRC’s levels of care. Also, ask about the management and financial stability. Check out the activity calendars. When you can, stop to talk with actual residents. Be sure to ask about a community’s entrance fee options to get a clear picture of which one would best fit your needs and wants.

Q: Is now the right time to move into a community?

A: “All signs point to YES!” Ok, there’s no magic eight ball that tells you when it’s time to move. But many CCRC residents say they wish they’d moved five years sooner. That’s because they didn’t realize until they moved in that their quality of life would improve because of all the benefits their community offered — the remarkable dining, wellness opportunities, friendships, packed calendar of activities, amenities, resident-driven clubs, and on and on. Something else to consider: If you wait until you need health care, you may not qualify for a Life Care contract in independent living.

Q: How do I know which type CCRC is right for me?

A: That depends on your priorities. Do you prefer to pay a bit more so you’ve got a plan no matter what the future may bring? Then a Type A CCRC might be the best fit. Or maybe you’re comfortable with paying less upfront to accept more risk in the future. In that case, a Type C CCRC may be better.

Q: What are the differences between Fee For Service (FFS) and Life Care contracts?

A: Some CCRCs offer both FFS and Life Care contracts, while others may offer both Type A and Type B contracts. FFS entrance fees and monthly service fees tend to be lower because you are paying for fewer benefits, like advantageous health care rates. A CCRC that offers a Life Care contract helps protect your assets by controlling the cost of higher levels of care, if/when you need them. This allows you to better predict potential health care expenses. Life Care contracts are even more financially advantageous to couples. For the same basic monthly service fee, if one spouse needs nursing care, they can receive it for as long as needed in the community’s on-site health center while the other spouse stays in the apartment home. In a similar scenario at an FFS community, a couple will pay both the monthly service fee on their apartment home and the market rate for higher levels of care. This unplanned spike in monthly costs could empty a nest egg rapidly and unexpectedly. Plus, with a Life Care contract, you have an opportunity to take a tax deduction, which is something FFS contracts don’t offer.

OTHER QUESTIONS? WE’RE HERE TO HELP.

Got more questions about CCRC contracts? We’re ready to answer them! We work with seniors and their families every day, helping them find the right fit for their lifestyle and finances. Call one of our Life Care Consultants at (732) 942-5272, or send us your question using the Contact Us form, and we’ll help you navigate your senior living search.